-

Our Models

Symphony Model

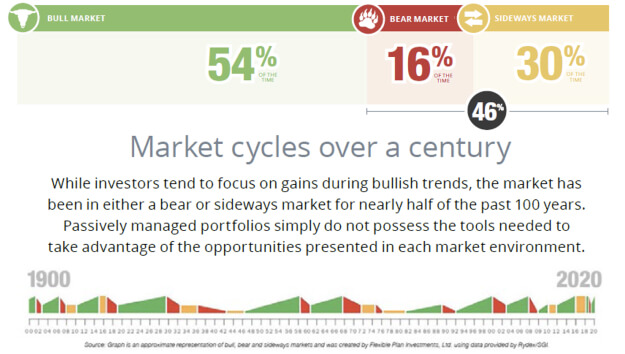

PortfoliosThe Symphony model is a true strategy of strategies that utilizes our proprietary Quantified Funds. Based on over 20 years of multi-strategy portfolio creation experience, FPI has found that combining actively managed strategies can help provide additional layers of portfolio defense and return potential.

Sign in to View More

Common Ground

BRI+ESG Model PortfoliosCommon Ground is a dynamic, risk-managed investment model utilizing our proprietary Quantified Common Ground Fund. The Common Ground Fund draws upon a universe of stocks rated highly by both ESG (based on rating from CSRHub, an ESG ratings aggregator) and Judeo-Christian metrics (based on ratings from eVALUEator). The Fund is used as the equity portion of the Model. The non-equity portion of the Model can utilize government bond, gold and cash asset classes. Combining these elements allows us to offer a single risk-managed solution that financial professionals may use with clients seeking faith-based investments or an ESG exposure to financial markets.

Sign in to View More

Large Cap Trend

Model PortfoliosTrend following is arguably one of the oldest trading strategies. Momentum in asset prices is an important element of factor investing. Large-Cap Trend Model utilizes allocations in our proprietary Quantified Funds and is intended to be used by financial professionals as a potential core equity holding for their clients.

Sign in to View More

- How to invest

- Our approach

- Meet the team

- Our method

- Contact us

Model Updates

Model Updates Convenience

Convenience Personalized

Personalized Up to date

Up to date